Federal fiscal stimulus has played a pivotal role in helping the U.S. economy recover from 2020 jolts, according to the Association of Equipment Manufacturers. Over the next couple of years, the Milwaukee group and economic consultants see additional proposals ushering much potential for the construction industry.

“We’ve included the American Jobs Plan (AJP) in our forecast,” says Mark Killion, director of U.S. Industry at Oxford Economics. “That is a significant assumption. There is a big infrastructure component to the AJP that could offer a lot of fuel for growth.” With respect to the public health situation, he adds, how the remainder of the 2021 plays out will also impact the next couple of years. Oxford Economics’ baseline forecast calls for 7.3 percent GDP growth in 2022. If vaccines show limited effectiveness against Covid-19 variants, growth may be just under 3 percent. If inflation persists, growth might be just under 6 percent. If all stars align and a “consumer boom” ensues, growth could jump to nearly 10 percent.

INFRASTRUCTURE SPENDING

Focusing on just the manufacturing and construction sectors, model simulations indicate that the AJP could help raise output 3.5 percent by the end of 2023, and drive a significant increase in non-residential infrastructure spending. “The private, local, state and federal sectors are all expected to boom away with double-digit growth at least through next year and 2023,” notes Killion.

Federal spending would take the most dramatic upward turn. Annual percentage increases from 2022 through 2025 are anticipated to be 29.4 percent, 26 percent, 12.5 percent and 2.5 percent, respectively. That’s a total increase of 70 percent over a four-year period. Contrast that with 2015-2019, when federal spending increased just 4.8 percent. State and local infrastructure spending would also get a big lift from the AJP, spurring projected growth of 33 percent over the next four years. Funding from the private sector is expected to grow 37 percent through 2025.

NONRESIDENTIAL MARKETS

If the AJP is signed into law, the prognosis for infrastructure spending looks good from every direction. By contrast, Killion sees construction spending for business and commerce offering a mixed outlook. Some sectors have benefited from increased government funding, including health care and education. Others, such as office buildings, have not fared well. Some sectors, including warehouses and transportation facilities, have benefited from private funding.

“That’s why the business sector as a whole has looked pretty decent, but the outlook remains quite mixed,” Killion observes. Total put in place construction for business and commerce was flat this year. Growth of 2.9 percent is expected next year, followed by 7.5 percent, 5.4 percent and 3.5 percent from 2023-2025. “Construction spending in this sector appears to be following the pattern of business investment in general,” Killion adds.

RESIDENTIAL PIPELINE PLUGGED

The housing market has been building up growth over the past couple of years. In 2020, private residential spending was largely driven by new single-family homes and existing home improvements. Looking forward through 2026, the most growth will come from single-family home construction.

Accelerating new home construction has become urgent, with housing affordability emerging as a major issue. Unfortunately, supply hasn’t been able to keep up with demand. Material and labor shortages have caused a sharp increase in homebuilder backlogs not seen since 2006. Booming home prices have added to existing concerns over inflation. “Housing affordability has become a widespread phenomenon throughout the U.S.,” Killion affirms. In fact, the U.S. now ranks fourth globally for year-over-year home price increases behind Sweden, Denmark and Russia.

PRICING, DEMAND RISE

U.S. home pricing isn’t the only thing on the rise. According to Killion, manufacturing inflation pressures have also been high, though they may have reached their peak. Orders for construction machinery continued to climb through the first half of this year. Even though orders may now have peaked, Killion finds that they are still at a high level. As a result, a gain of roughly 15 percent in real gross output is expected this year, followed by 4 percent and 1 percent bumps in 2022-23, and 6 percent from 2024-28.

AEM Director of Market Intelligence Benjamin Duyck notes that while the construction equipment industry continues to be in a boom cycle, more stability is also taking shape.

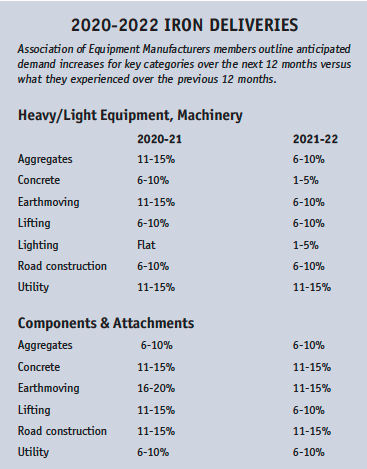

According to AEM Q2 member survey results, roughly 71 percent of respondents reported demand increasing from the first quarter. Nearly 25 percent confirm that demand has remained stable in 2021. Last year at this time, 85 percent of survey respondents felt demand had grown quarter to quarter, and just 10 percent said demand for the year was stable. Furthermore, 85 percent of AEM members predict growth over the next 12 months with only 1 percent anticipating a decline.

“Demand for almost every construction equipment category remains green with perhaps some stability for lighting equipment,” notes Duyck. “That said, we are seeing slightly lower numbers for the next 12 months. This is perhaps due to the stronger-than-expected growth earlier this year.”

INVENTORIES DROP, BACKLOGS GROW

With demand continuing to cruise along, more AEM members are now indicating inventory levels that are too low. Roughly 45 percent say levels have been falling over the past several months.

“When a company says inventory is too low, it generally means it is not on purpose and that production must increase rapidly,” Duyck observes.

Most AEM members have been able to increase production to some degree. But new orders are also increasing, leading to backlog growth. Among Q2 survey respondents in the Heavy/Light Equipment category, 66 percent, 83 percent and 87 percent reported production, new order and backlog increases, respectively. Among Components & Attachments category respondents, 90 percent or more reported Q2 production, new order and backlog increases across the board.

“Close to 95 percent of AEM members are experiencing supply chain issues,” says Duyck. “For more than half, those issues are getting worse and are both domestic and global. Component manufacturers and OEMs feel that the main issue does not necessarily lie at the end-point or receiving shipping. Rather, the main issue is at the supplier source and especially international shipping.”